Aral Nederland Handelsplatform Beoordeling

Aral Netherlands is een handelsplatform dat naam maakt in cryptocurrencies door geavanceerde technologieën. Door kunstmatige intelligentie (AI) te combineren met de mogelijkheden van quantum computing, wil het de handel in digitale valuta optimaliseren . De app belooft hoge slagingspercentages en biedt klantgerichte ondersteuning aan zijn gebruikers. Dankzij de verscheidenheid aan cryptocurrencies die op de site beschikbaar zijn, hebben investeerders een breed scala aan handelsmogelijkheden.

De beoordeling van deze technologie is echter niet uniform. Het internet biedt verschillende getuigenissen, van positieve uitspraken over efficiëntie en gebruiksvriendelijkheid tot waarschuwingen over risico's en fraude. Daarom moeten potentiële gebruikers elk handelsplatform grondig onderzoeken voordat ze investeren. Het bekijken van gebruikersbeoordelingen en het verkrijgen van actuele informatie van officiële instanties kan helpen om een duidelijker beeld van Aral te krijgen. Vanwege de polariserende meningen is zorgvuldige en kritische overweging aan te raden om weloverwogen beslissingen te nemen.

AI in Aral Trading Bot

Aral Nederland vertrouwt op geavanceerde kunstmatige intelligentie (AI)-technologie, met name machine learning-methoden, om handelsbeslissingen te nemen in het bijna verwarrende cryptocurrencylandschap . De integratie van quantum computing belooft een nieuw niveau van gegevensverwerking.

Machinaal leren

De basis van kwantum-kunstmatige intelligentie is machinaal leren, waarmee systemen kunnen leren en beslissingen kunnen nemen zonder expliciete programmering . toegepast naar crypto handel , dit middelen :

- Patroonherkenning: Aral analyseert grote hoeveelheden historische marktgegevens om patronen en trends in de marktactiviteit te identificeren en toekomstige ontwikkelingen te voorspellen.

- Aanpassingsvermogen: De algoritmen passen zich voortdurend aan veranderende marktomstandigheden aan om potentieel winstgevende handelsstrategieën te ontwikkelen en te implementeren.

Aral versus geautomatiseerde handel

Aral Nederland vertegenwoordigt een paradigmaverschuiving in de manier waarop AI-algoritmen data verwerken:

- Snelheid en complexiteit: Vergeleken met klassieke computing kan Aral complexe problemen sneller oplossen en enorme hoeveelheden data verwerken.

- Quantum Supremacy: Aral voert berekeningen uit die onmogelijk zijn voor conventionele computers.

Aral, dat machine learning en quantum computing combineert, wil cryptovalutahandelaren een duidelijk voordeel geven . De efficiëntie van de algoritmes en de snelheid van de gegevensverwerking zijn de topprioriteiten om snel te reageren op marktgebeurtenissen.

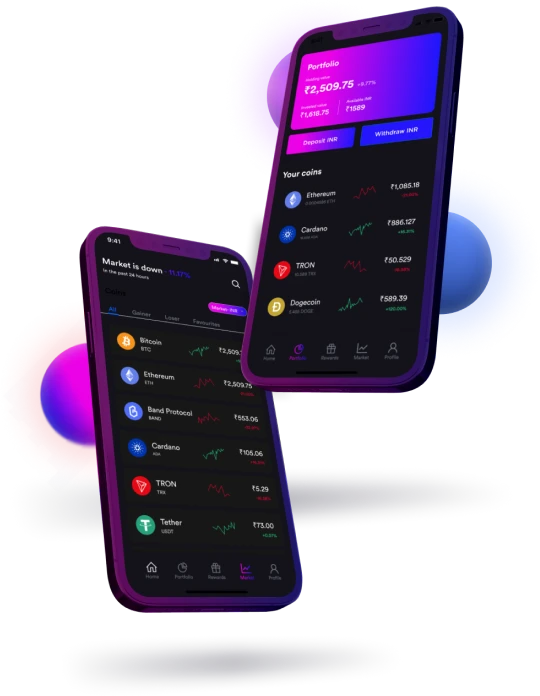

Aral-app en platform

De Aral trading bot is ontworpen om gebruikers in staat te stellen om verschillende activa te verhandelen, zoals cryptocurrencies en CFD's. De gebruiksvriendelijke interface, beveiligingsmaatregelen, demo-account en redelijke minimale storting maken het makkelijk om te beginnen; er is geen speciale mobiele app voor iOS of Android; de mobiele site is echter goed geoptimaliseerd voor mobiele browsers op beide besturingssystemen.

Functionaliteit

Het platform gebruikt algoritmen gebaseerd op quantum computing-technologie om handelsmogelijkheden te identificeren en analyseren . Deze algoritmen zijn gericht op het uitvoeren van marktanalyses op hoge snelheid, waarbij Aral App:

- Marktindicatoren worden in realtime verwerkt

- Implementeert geautomatiseerd handel strategieën

- Er wordt rekening gehouden met gebruikersvoorkeuren zoals risiconiveaus en investeringsbedragen

Veiligheidsmaatregelen

Aral Nederland geeft prioriteit aan de veiligheid van haar gebruikers door verschillende beschermingsmaatregelen te implementeren:

- Versleuteling: Gevoelige gegevens worden beschermd door SSL-versleuteling.

- Privacybeleid: Er zijn duidelijke privacybeleidsregels om de persoonlijke gegevens van gebruikers te beschermen.

- Verificatieprocessen: Om de integriteit van het gebruikersaccount te waarborgen, zijn identiteitsverificatieprocessen standaard ingebouwd.

Er dient echter te worden opgemerkt dat de autoriteiten duidelijk maken dat de exploitanten van het Aral-platform geen toestemming hebben om bankzaken te doen of financiële diensten te verlenen.

Demo-account en minimale storting

Aral biedt potentiële investeerders de mogelijkheid om het platform risicoloos te testen met een demo-account. Dit account:

- Simuleert handelsactiviteiten in een risicovrije omgeving

- Dit zal gebruikers in staat stellen om vertrouwd te raken met het platform

De minimale storting voor live trading is meestal een bedrag dat als toegankelijk wordt beschouwd voor beginners - vaak in het driecijferige bereik. Gebruikers moeten alleen geld investeren dat ze zich kunnen veroorloven te verliezen, aangezien ze zich bewust moeten zijn van de risico's die gepaard gaan met trading.

Cryptocurrencies en handelsstrategieën

Cryptocurrencies zoals Bitcoin en Ethereum hebben specifieke marktkenmerken die handelsstrategieën beïnvloeden. Het gebruik van technische indicatoren en een begrip van handelsmogelijkheden zijn cruciaal voor een betrouwbare winstpercentage.

Bitcoin en Ethereum

Bitcoin , de eerste en bekendste cryptocurrency , en Ethereum , bekend om zijn smart contracts, zijn toonaangevende digitale valuta's met aanzienlijke marktvolatiliteit. Zulke schommelingen stellen handelaren in staat winst te maken, maar vereisen een solide strategie.

Bitcoin (BTC):

Volatiliteit: Hoog

Gemiddelde winstpercentage: variabel

Veelgebruikte indicatoren: voortschrijdende gemiddelden, RSI (Relative Strength Index)

Ethereum (ETH):

Volatiliteit: gemiddeld tot hoog

Mogelijkheid voor slimme contracten: Ja

Populaire handelsstrategieën: swingtrading, scalping

Handelsmogelijkheden en indicatoren

De beschikbaarheid van diverse cryptocurrency trading opties stelt investeerders in staat om verschillende benaderingen te gebruiken om hun portefeuilles te diversifiëren en aanpassingen te maken tijdens markt onzekerheid. Indicatoren spelen een centrale rol bij het analyseren van markttrends en het nemen van handelsbeslissingen.

Handel mogelijkheden :

- Plek handel

- Marge handel

- Toekomstige En opties

- CFD's ( contracten) voor Verschil )

Indicatoren :

- MACD (Moving Average Convergence Divergence)

- Bollinger Banden

- Stochastisch Oscillator

- Fibonacci terugtrekking niveau

De selectie en combinatie van deze indicatoren hangt af van de door de handelaar gewenste handelsstrategie en het risicoprofiel.

Is Aral nep ? Transparantie en ernst van het bedrijf

Bij het beoordelen van de transparantie en betrouwbaarheid van een bedrijf is het van cruciaal belang om diepgaand onderzoek te doen en beoordelingen en getuigenissen grondig te analyseren .

Onderzoek en voorzichtigheid

De oprechtheid van Aral moet worden geverifieerd met behulp van officiële informatie en beschikbare bedrijfsgegevens. Geïnteresseerde partijen moeten bepalen of het bedrijf de juiste licenties heeft en wordt gereguleerd door financiële toezichthouders. Onderzoek suggereert bijvoorbeeld dat voorzichtigheid moet worden betracht met betrekking tot beleggingsformulieren als een platform niet de benodigde autorisaties heeft om zijn activiteiten uit te voeren.

Beoordelingen en getuigenissen

De ervaringen van andere gebruikers zijn een waardevolle bron van informatie. Het is noodzakelijk om positieve en negatieve beoordelingen te bekijken en hun geloofwaardigheid te controleren. Een hoog aantal getuigenissen die het genoemde succespercentage van meer dan 90% bevestigen, kan een positieve indicator zijn. Een kritische overweging is echter op zijn plaats, vooral wanneer rapporten onduidelijke bedrijfspraktijken of een gebrek aan winstgevendheid melden.

Tariefstructuur en kosten

Kostenstructuren en kosten zijn cruciale factoren bij het omgaan met financiële platforms. Aral kenmerkt zich door een transparant kostenbeleid dat gebruikers een duidelijk overzicht geeft van de gemaakte kosten.

Kosten en commissies

Aral rekent een commissie van 0,01% per transactie. Deze vergoeding is van toepassing op de handel op het platform en is laag vergeleken met veel concurrenten. Er worden geen commissies gerekend, wat het platform aantrekkelijk maakt voor gebruikers.

Accountonderhoudskosten en inactiviteitskosten

Aral onderscheidt zich van andere aanbieders wat betreft de accountbeheerkosten. Er zijn geen kosten voor accountbeheer en geen inactiviteitskosten, wat betekent dat gebruikers niet worden gestraft als ze hun account gedurende een langere periode niet gebruiken.

Regelgeving en veiligheid

Regulering en veiligheid zijn van het grootste belang voor investeerders bij het gebruik van geautomatiseerde handelsplatformen zoals Aral. Deze platformen vereisen zorgvuldige monitoring door toezichthouders en moeten uitgebreide veiligheidsmaatregelen toepassen om persoonlijke gegevens te beschermen.

Toezichthoudende autoriteiten

De Financial Authority speelt een cruciale rol bij het reguleren en controleren van financiële dienstverleners in Nederland, en onderzoeken naar handelsplatformen zoals Aral zijn cruciaal om te bepalen of dergelijke bedrijven zonder vergunning opereren . Aangezien Aral lijkt te zijn aangesloten bij de Cyprus Securities and Exchange Commission ( CySEC ), kunnen investeerders erop vertrouwen dat er een bepaald niveau van gereguleerde beveiliging is. CySEC- partners betekenen een bepaald niveau van legaliteit in de handel. Toch moeten potentiële gebruikers ervoor zorgen dat een Nederlandse Financial Authority of een vergelijkbare toezichthoudende autoriteit ook het relevante platform autoriseert .

Verificatie en gegevensbescherming

Verificatie van gebruikersaccounts is cruciaal om te beschermen tegen fraude en witwassen, terwijl de veiligheid van de persoonlijke informatie van gebruikers wordt gewaarborgd. SSL-encryptie wordt gebruikt om de integriteit van gegevens te waarborgen en te beschermen tegen ongeautoriseerde toegang. Aral's verwerking van verificatie- en beveiligingsinformatie lijkt echter meer transparantie nodig te hebben. Toekomstige gebruikers moeten op de hoogte zijn van hun beveiligingsprotocollen en hoe ze persoonlijke en financiële informatie beschermen.

Klantenservice en -diensten

De kwaliteit van de klantenservice en betrouwbaarheid van trading bot- platforms zijn cruciaal voor de gebruikerservaring op een tradingplatform als Aral. Gebruikers verwachten efficiënte ondersteuning voor vragen en sterke tradingprestaties van het platform.

Klantenservice

Aral biedt haar gebruikers klantenservice die is ontworpen om vragen en problemen snel op te lossen. De communicatiekanalen waarmee de service kan worden benaderd, spelen een belangrijke rol voor gebruikers:

- Contact formulier op de website

- E-mail steun

- Live chatfunctie (indien beschikbaar)

De klantenservice van Aral streeft via deze kanalen naar een dialoog met klanten om een hoge klanttevredenheid te garanderen.

Betrouwbaarheid en prestaties

Een ander criterium voor het evalueren van een handelsplatform is de betrouwbaarheid en prestatie. Het gaat om de mate waarin het platform continu en zonder onderbrekingen kan functioneren. Hoog beschikbaarheid is essentieel En verwacht door gebruikers :

- Snel platform antwoord keer

- Laag stilstand

- Efficiënt uitvoering van handel transacties

Een stabiele werking vergroot het vertrouwen bij de gebruiker en is een teken van professionaliteit van de provider.

Risico's van geautomatiseerde bothandel

Bij het overwegen van Aral bot is het cruciaal om investerings- en handelsrisico's zorgvuldig te overwegen. Investeerders moeten zich bewust zijn van de inherente marktrisico's en schommelingen in succespercentages.